⚠️ An outage with our login provider may cause issues accessing our website. For the fastest assistance, please call (614) 665-5503⚠️

Real estate investors continuously struggle with the outdated title and closing process that’s expensive, time-consuming, and inefficient. These outdated processes force investors to waste precious time when they could be finding and closing new deals. Antiquated title solutions also result in investors burning precious capital on unnecessarily high closing costs.

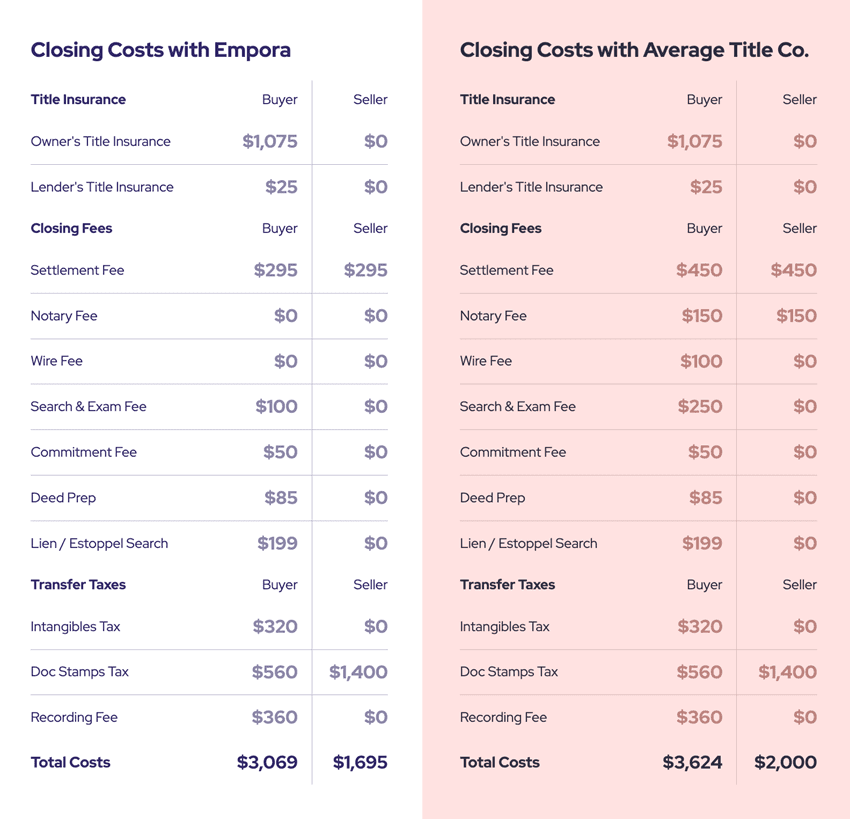

On average, Empora allows investors to save on closing costs. Customers doing 4+ deals per month can save tens of thousands of dollars in closing costs per year versus a typical title company. These savings increase profit margin on each deal and can be used to bankroll upcoming projects.

To instantly get a sense for how much they should expect to pay in closing costs with Empora vs. typical title company fees, real estate investors can use our closing cost calculator to estimate their closing costs. Home title fees for Empora (and for average title companies) can be calculated for each state where Empora operates: Ohio, Kentucky, Florida, and Indiana. (More states coming soon!)

A closing cost estimate is only seconds away with our new Closing Cost Calculator. Only 4 pieces of information are required to generate a closing cost estimate:

While closing costs vary by state, the below chart shows how our fees compare on a $250,000 property in Florida with $200,000 financed. In this scenario, the buyer would save $555 in closing costs and the seller would save $305 in closing costs for this single transaction. Our closing cost calculator is the best way to see how our fees compare with average title companies.

Closing costs can vary greatly between title companies, as can the line items that title companies charge for. Here are some of the most common fees charged by title companies.

Settlement fees are the fees you must pay to complete the sale of the property. Settlement fees may include additional fees like origination charges, recording fees, and property taxes, and it’s a mandatory fee that all real estate transactions include.

A search & exam fee is a fee that the buyer pays to ensure there are no breaks in the chain of title or unsatisfied liens or judgments on the property. This fee covers reviewing the ownership history to determine if someone besides the buyer or seller is legally tied to the property.

Notary fees are paid to the notary by the buyer and seller at closing for their services of notarizing the closing documents.

A wire fee is a fee that the buyer pays to send their money from one bank to another to complete the real estate transaction.

In addition to the fees listed above, there are many other “junk” fees that title companies charge. Junk fees can have many names. Here are a some of the more common junk fees: processing fees, email fees, underwriting fees, application fees, disclosure fees, and courier fees.

Empora’s digital-first title solution creates a closing process that is more efficient for all parties involved. We’ve built our title solution differently than other typical title companies, which means using Empora is less costly and we pass the savings right on to our customers. Our closings happen faster than average title companies which makes it ideal for investors who want to scale their real estate business and close more deals.

Just because typical title companies charge unnecessary fees doesn’t mean we have to. Our Closing Cost Calculator ensures transparency in the title and closing process. You won’t be hit with any unanticipated fees or charges since you know exactly what you’ll need to bring to closing ahead of time.

The typical title and closing process is outdated and ripe for innovation. Empora is at the forefront of creating a digital-first solution that delivers the fastest closings with the lowest fees.

While saving money on closing costs is one of the reasons our customers love Empora, it’s generally not the main reason they tend to stay with us. Our platform allows investors to close deals faster with fewer headaches. Empora is ideal for investors who close a high volume of deals and regularly manage multiple transactions each month.

Try our Closing Cost Calculator to get an idea of what you could be saving or submit a deal to experience Empora’s reduced closing costs and streamlined closing process built for savvy real estate investors!

Company

Location

145 E Rich St, Floor 4

Columbus, OH 43215

Contact

OUR PARTNERS

© 2025 Empora Title